Grant Thornton’s Managing Partner Hisham Farouk tackles the contentious issues of succession and governance in family-owned enterprises

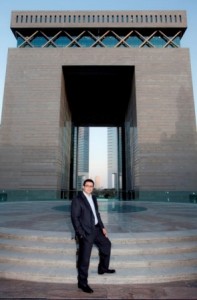

CONSUMMATE PROFESSIONAL: Hisham Farouk is an exemplary example of how a future leader can embrace change and drive a business forward in an innovative manner.

IT IS SAID that a man’s worth is no greater than the worth of his ambitions. This phrase best suits Hisham Farouk, given that at a young age of 35, his achievements and accomplishment in his accounting and auditing career have preceded him.

The dynamic leader joined the profession in 1998 and is now leading the audit and advisory firm Grant Thornton (GT) UAE to the next growth phase, after a successful career in assurance services with a number of large family owned businesses in the region.

As the Managing Partner of Grant Thornton UAE, Hisham has been tackling various issues in family owned businesses which cover succession, governance, public listing (IPO) and operations, among others.

Potential for growth

He is well positioned to understand the family owned business market given the fact that Grant Thornton UAE (member firm of Grant Thornton International Ltd, one of the world’s leading organisations of independent assurance, tax and advisory firms) was founded by his father, Farouk Mohammed in 1966.

Grant Thornton is one of the largest global advisors to family-owned businesses and has worked with a number of local businesses who are going public. Recently the firm was appointed to conduct an independent professional valuation of the Al Habtoor Group, ahead of the company’s potential public listing early next year.

Hisham said in an exclusive interview with Accountant Middle East; “Grant Thornton has witnessed the transformation of UAE in its primary history to where it stands today, as one of the leading economies in the world. Family-owned businesses have contributed to this transformation, and continue to push the country into its next phase.”

Family-owned enterprises represent more than 90% of the business community in the UAE, according to a recent study published in the UAE. This fact alone highlights the significance this sector plays on the local economy. In order for the UAE to move further forward it is essential for these family-owned businesses to recognise how they can unlock their potential for growth.

Charting own course

While elucidating the key issues that are needed in family-owned businesses when planning succession, Hisham said;

“Succession planning and the introduction of young dynamic leaders is essential to continued business growth and innovative thinking. The founders of family-owned businesses may have expectations of their family charting their own course in life, but the reality is that the family business is embedded into each member from an early age. It is only when the family members start to take an active interest in the business that the founders consider the business to be a viable career path.”

He however cautions that sharing a business can do much to strengthen the family bond, but passing a family business from one generation to the next can be a complicated process and one which needs to be managed and planned with care.

“The incumbent management has a great wealth of management experience and this skill has to be inculcated on to the younger generation who are taking over, it should be done in a very open and transparent manner to ensure that there is stability in the company. The ultimate objective is to guarantee that the business is not hurt during the corporate restructuring and transitioning period. All the stakeholders must agree that productivity and smooth functioning of the company is the ultimate goal.”

“Shadowing the founders of the business is not sufficient enough for these young leaders, who are trying to move the business forward in an era of increased competition. The introduction of an external management team and independent auditor are imperative in strategically aligning the business growth strategies to the market demand and opportunity.”

Role of non-executives

According to the executive, independent non-executives play a critical role in encouraging further new thinking in the business; this also allays fears regarding conflicting goals and loss of control of the business.

“In family-owned business, the primary stakeholders are the family members. Therefore it is the onus of the family members to bring in an executive board that is qualified to provide independent suggestions for the growth of the business,” Hisham said, adding that the presence of independent senior members on the board, capable of challenging the decisions of the management, is widely considered as a means of protecting the interests of stakeholders too.

“This external management team must have an added value, the required skill set and the necessary expertise in order to aid the growth of the business. Most importantly, there has to be chemistry between the board and the family owners. The family members must communicate openly and transparently with the board, especially on the key matters concerning the business.”

Business diversification

SUCCESSION PLANNING: “The introduction of young dynamic leaders in family-owned businesses is essential to continued business growth and innovative thinking,” Hisham says.

In addition to the introduction of an external management team; Hisham strongly recommends the services of an independent auditor. However, he said that family members and the board must ensure that the accounting team comprises of the right individuals who can be relied upon to provide objective reporting.

“Whether they have an independent audit or not, the main questions to consider are; what is the added value… or what is the unique information they are getting from these auditors which would help them take the business to the next level?”

“Material changes happen in family businesses, for instance a lot of them started as core businesses or core industries and diversified to many sectors. So you may have a family business that started off in real estate and later on diversified into banking, hospitality, construction, among others. As an independent advisor, I would want to look at how these different arms of business are providing balance, complementing or providing synergy to each other, or what the opportunity cost is.”

“This has been the natural evolution through our time. Where these businesses are at today is sustaining that structure and moving on to the next level.”

“On the other hand, if I was the business owner, I would expect my independent audit advisor to provide a transparent audit report, supported by analytics which would aid the management team to make effective business decisions, this is particularly important for succession purposes,” Hisham adds.

“But I think the most important thing is when the patriarch or the head of the family business hands over the reins of the business. He would like to hand over a business that is ready and clean, a business that is not saddled with debts or litigations or management and family conflicts, in order to make it easier for the next generation to grow the business and take it to the next level,” the executive says.

Traditional attitudes

Like in the other GCC countries, family-owned enterprises represent more than 90% of the business community in the UAE, according to a recent study published in the UAE, which also states that nearly 70% of the over 20,000 family companies in the GCC are still dominated by the old founding members, who “control these firms with traditional methods and attitudes”.

Statistics provided in the research authored by Saleh Al Rousan, economic adviser at the Ras Al Khaimah Chamber of Commerce and Industry, show that these companies contribute nearly 75-95% of the sector’s trade activity in the region, with investments reaching $500 billion.

“Their total global wealth is estimated at over $2 trillion and they employ nearly 15 million people,” it states. The study goes on to add that only around 30% of these companies are controlled by the second or third founding generation.

“Local governments should prompt these family-owned companies to ensure transparency, and curb the domination of social habits and traditions which influence their activities and obstruct their development,” the study states.

Leaders of tomorrow

Hisham echoes the same sentiments, warning that some family owned businesses are still dominated by the founding members, who manage these firms with traditional views.

“It is important to embrace the change in technology and globalisation, which the young generation are already at abreast with – positioning them as the leaders of tomorrow,” he says.

Hisham specialises in a wide range of industries across the region. He is the Client Relations Partner and point of contact for all DIFC related services where he is also a licensed insolvency practitioner and is also a registered auditor with the UAE Ministry of Economy.

The young executive is an exemplary example of how a future leader can embrace change and drive a business forward in an innovative manner.