Industry expert Kurt Ramin examines the values identified in the prototype of business reporting framework issued by the International Integrated Reporting Council

THE FIRST step towards the development of an integrated business reporting framework was the publication of the ‘Discussion Paper’ in 2011 resulting in a release of a prototype framework in November 2012.

The further timetable calls for a draft framework to be issued by April 2013, followed by a final ‘version 1.0’ in December 2013. The International Integrated Reporting Council (IIRC) is also planning to publish subsidiary papers on a range of topics during early 2013. These topics are likely to include connectivity, the business model, the capitals, the concepts of value and materiality.

Discussion Paper and Framework

The Discussion Paper seeks to build on existing developments in reporting such as the international convergence of accounting standards, sustainability guidance published by organisations such as the Global Reporting Initiative (GRI), and the IASB’s IFRS Practice Statement “Management Commentary” (with lots of content from PwC’s Value Reporting).

The core of the discussion paper, a 29 page document, focuses on key definitions, outline of Integrated Reporting (IR) building blocks and outlining the future direction of the project. Designed as an initial exposure of the project, 214 responses and comments from a wide stakeholder group were received.

The 51 page prototype framework was published November 26, 2012. It contains the following guidance:

The fundamental concepts underpinning IR revolve around the various capitals that the organisation uses and affects, the organisation’s business model, and the creation of value over time. These concepts, which are discussed in Chapter 2, and the reporting requirements and guidance in Chapters 3–5 are mutually reinforcing. An organisation’s business model is the vehicle through which it creates value. That value is embodied in the capitals that it uses and affects. (see IIRC [November 26, 2012], p. 2). www.theiirc.org

The Six Capitals

In the glossary of prototype framework, ‘Capitals’ are defined as “Stores of value on which all organisations depend for their success as inputs, in one form or another, to their business model, through which they are increased, decreased or transformed. The capitals identified in this framework are: financial, manufactured, human, intellectual, natural, and social and relationship.”

The capitals are sometimes also referred to as “resources and relationships”.

Three Simple Capitals

The prototype framework states that the categorisation and description of the aforementioned six capitals continues to be considered. While it is likely the categorisation will remain unchanged, it is also likely that the descriptions will be refined (see IIRC [November 26, 2012], p. 11).

However, I suggest, that Business reporting would be even further simplified if the capitals could be combined into the following three categories, for easy reference called the three P’s.

i. People Activities Capital (Human Capital and Social and Relationship Capital)

ii. Physical Infrastructure Capital (Manufactured Capital and Natural Capital)

iii. Product (service) Supply Chain Capital (a new category, usually the carrier and driver of Intellectual and Financial Capital)

Intellectual Capital (IC, Value) is a component and attribute in all three categories (3 P’s) and should act as a bridge between reporting financial and Non-Financial information. The IIRC prototype paper states, that, very similar to Intellectual Capital, not all capitals an organisation uses or that it affects are owned by it. They may be owned by others, or may not be owned at all in a legal sense (for example, access to unpolluted air). On a wider scale, the boundaries of Intellectual Capital are beyond control of the organisation. (see IIRC [November 26, 2012], p. 13).

Financial Capital can be seen as an offsetting and reconciling Cash Statement to owners, funders and other stakeholders, including tax authorities and other contract related legal commitments. In this regard, presentation and a better integration of the Cash Flow Statement with the other parts of financial statements were considered in joint work by the IASB and FASB and documented in a discussion paper in 2010.

The simplified capital categorisation would link the three capitals identified closer to the input/output model of the business model for integrated reporting (see IIRC [November 26, 2012], p 13).

Figure 1: Business Model for Integrated Reporting

Tracking, valuation and describing attributes (currently mostly in disclosures) should be aligned to each of the 3 P’s and a great deal of duplication and mapping in data collection for reporting could be avoided. (for example GRI information on people: “combine all people information such as salaries, bonus payments, stock options and awards, direct travel expense, employee commuting, memberships, benefits, pension expense, training and education expense, diversity and equal opportunity information, equal remuneration men and women, health and safety information, collective bargaining, child labour information, indigenous rights information, etc.”.

Tracking, valuation and describing attributes (currently mostly in disclosures) should be aligned to each of the 3 P’s and a great deal of duplication and mapping in data collection for reporting could be avoided. (for example GRI information on people: “combine all people information such as salaries, bonus payments, stock options and awards, direct travel expense, employee commuting, memberships, benefits, pension expense, training and education expense, diversity and equal opportunity information, equal remuneration men and women, health and safety information, collective bargaining, child labour information, indigenous rights information, etc.”.

A segmentation on people reporting, for instance men/women employees, part-time/full-time, highly paid/lower paid, in a standard taxonomy would be helpful to make the data comparable.)

Obviously, currently used performance measurements, ratios, matrixes and KPI’s can and should be aligned to the three categories of capital (three P’s).

Organising Data

Since the introduction of the term “data warehousing” in 1990, companies have explored ways they can capture, store and manipulate data for analysis and decision support. At the same time, many companies have been instituting enterprise resource planning (ERP) software to coordinate the common functions of an enterprise.

The web has changed the picture again in that very large amounts of data are being produced and software systems can be downloaded and used from the “cloud”. Taxonomies using eXtensible Business Reporting Language (XBRL) are being built to organise data, transport it and to reduce mapping. This will force new approaches in data validation and assurance.

XBRL (eXtensible Business Reporting Language)

In the Integrated Reporting Prototype Framework, XBRL is mentioned under “Connectivity of Information” and “Use of Technology” (see IIRC [November 26, 2012], pp 22 and 45.

XBRL(eXtensible Business Reporting Language) is a dialect of eXtensible Markup Language (XML), the universally preferred language for transmitting information via the Internet. XBRL improves the way information is created, processed, distributed and analyzed by providing standardised definitions, labels, calculations, references and contexts applicable to individual numbers and narrative text. Two beneficial characteristics of XBRL that improve connectivity are: Consistent semantic definitions of, and explicit relationships between components of an integrated report.

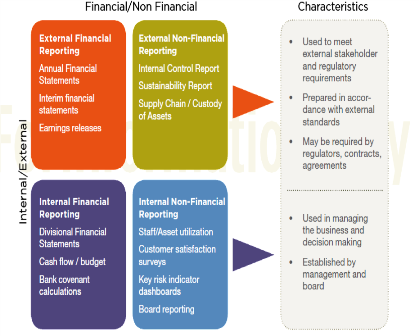

Currently, the use of XBRL is largely restricted to transmit financial information. However, as a technology – and as its name suggests – XBRL is highly extensible and adaptable. It can be applied for general business reporting and there are a number of global initiatives looking to leverage XBRL for non-financial reporting, for instance, environmental, social and governance reporting. Besides financial reporting, XBRL taxonomies (example, IFRS taxonomy), taxonomies are now available for GRI and climate change data.

XBRL has great powers in the transportation and organisation of information, but it has limited utilities in tracking data and information of moving objects.

Tracking & Mapping of Information on 3 P‘s

How can we track and map objects and data on the 3 P’s to enhance reporting on their existence and validation?

People: Technology now makes it possible to track people and locate them anywhere in the world. Numerous applications and system enhancements are reported every day. LinkedIn, the business people network, claims to be close to a membership of 200 million people being connected. There are now global time tracking, payroll and expense report systems in place, allowing data to be more comparable and consistent.

Physical Infrastructure: ESRI, Google maps, picture recognition and RFID, etc. enable a clear identification and tracking of physical infrastructure. Increased use of technology and location based information by the public sector and governments would enhance transparency of the volume and use of Natural Capital.

Products: Object tracking of products is probably the most advanced of the three P’s. Several industry sectors and supply chains have already integrated their product numbers and identification features. For instance, Amazon and eBay have huge databases of product information.

The global car industry would be one of the best examples to test the system for the segmentation into the three capitals. The industry is an employer of large numbers of people; car production needs physical infrastructure and natural capital and has a good tracking mechanism throughout the product supply chain.

The sector has an important market share, competition and influence on financial flows and capital (leasing, consumer finance, currency hedges, etc). Through the use of telematics (telecommunications and informatics) tracking with GPS functionality is at the core of future systems for the car industry. Unfortunately, as of November 27, 2012 the IR Pilot Programme Business Network of 80 companies does not yet include a typical car company.

An integrated approach?

Approaches and expenses for the assurance of financial and non-financial reports are even more divergent than the reporting of it. There is a huge variation on audit fees by type of industry and internationally, still reflecting international auditing differences.

For the audit of the financial statements of Deutsche Bank, which employed 100,000 people globally in 2011, external expenses for audit and related fees for 2011 amounted to 76 million euros. The audit and related fees for Beiersdorf (“Nivea”), which employed 19,000 people globally and is valued at 50 % of Deutsche Bank (December 2012), external audit related expenses amounted to only 1.5 million euros for 2011.

Beiersdorf is able to track their products on a detailed basis, whereas the financial product supply chain (Deutsche Bank) is not as transparent, in particular on an international scale. Ironically, due to a larger amount of information presented, assurance expenses for reports on sustainability and non-financial information are a fraction of what the expense are for financial audits with most companies performing self-assessment or other kinds of assurance.

Good internal control is fundamental to any successful audit. In 1992 the Commission of Sponsoring Organisations of the Treadway Commission (COSO) released its first paper on internal control, enterprise risk management and fraud deterrence. The original framework has gained broad acceptance and is now widely used around the globe.

In December 2011 COSO presented an updated version “Internal Control – Integrated Framework” with exposure during 2012. COSO anticipates releasing the final update to its internal control framework in the first quarter of 2013. A graphical presentation of the COSO assurance model is presented in Figure 2.

Figure 2: Assurance: Internal Control – Integrated Framework (COSO)

On September 11, 2012 the International Federation of Accountants (IFAC) released a new publication “Evaluating and Improving Internal Control in Organisations”.

On September 11, 2012 the International Federation of Accountants (IFAC) released a new publication “Evaluating and Improving Internal Control in Organisations”.

At the same time there is movement to improve the Auditor’s Report. (IFAC’s Exposure Draft “Improving the Auditors Report”, June 2012). Views vary over the appropriate content and structure for reports, and particularly over the issue of “auditor commentary.” However, there seems to be agreement that an integrated audit opinion (single opinion) has to provide more detail than the current “boilerplate” language provided. The auditor’s report should reflect the auditors understanding of the company, its strategy and overall performance.

An approach to greater auditor specificity is embedded in AccountAbility’s AA1000 AS (Assurance Standard) for sustainability reports. It requires the auditor to comment and report on 15 check points.

Clearly, creating a data driven reporting structure would simplify and strengthen the assurance for a truly integrated business report.

Governance, Risk and Compliance

Governance is probably one of the most important ingredients of steering a particular business model to success over the longer term. The tone at the top and vision, either by one individual or a team of expert board members or employees/contractors, has far-reaching effects on the attitude towards risks and dealing with opportunities and exploiting them. Governance issues, therefore, form a large part of the IIRC Prototype Framework.

The level of political risk influences decisions where organisations start to place, to continue and expand certain objects.Taxation and compliance with local control frameworks, fraud and corruption levels and other laws play an important other role, besides workforce availability and education. Legacy tax systems, especially on the determination of income, often lead to a de-concentration from the original business model.

To achieve better Validation, we need to separate objects and value. Recently, the International Valuation Standards Council (IVSC) has made great strides to establish standards to be applied on a global basis, but the committee’s efforts deserve more attention to put the standards further ahead in the forefront of valuation and to provide a more consistent definition of values than what is currently outlined in the prototype framework. (see IIRC [November 26, 2012] pp. 17-19). Sir David Tweedie, former Chairman of the IASB, is now heading up the IVSC. This should provide the power to make the progress needed.

Legal differences hinder the implementation of best governance and compliance practices (for example as promulgated by the OECD). Only a few international business entities are able to balance political risk on a global scale. These organisations could serve as a model for a common governance format of an Integrated Business Report.

Looking ahead

Integrated Reports are here to stay. However, to be useful, the business report has to be presented in a simple and understandable format. A capital orientation to describe past and future performance could be a helpful way moving forward. People, Physical Infrastructure and Products (three P’s) relate well to the pillars of Intellectual Capital: Human Assets, Structural Capital and Relational Capital. Along those lines we can track objects, value them consistently and place management commentaries and segmented information on them, where necessary and material.

Integrated Reports are here to stay. However, to be useful, the business report has to be presented in a simple and understandable format. A capital orientation to describe past and future performance could be a helpful way moving forward. People, Physical Infrastructure and Products (three P’s) relate well to the pillars of Intellectual Capital: Human Assets, Structural Capital and Relational Capital. Along those lines we can track objects, value them consistently and place management commentaries and segmented information on them, where necessary and material.

In Business Reporting, we need to use more technology to track objects and build taxonomies to make the reports comparable. I always said convergence of standards and valuation techniques (for example US GAAP and IFRS) will only happen through the further use of technology. This will reduce the need for local adjustments, language translations and interpretation. In the longer term, a paradigm shift will have an effect on education, market valuations, taxation and the worldwide adoption of a new Model BusinessReport describing the entities current, past and future activities and environmental involvements in an integrated fashion.

*To find out more about on the concept Objects x Value, see Ramin/Reiman: IFRS and XBRL: How to improve Business Reporting through Technology and Object Tracking, Wiley, January 2013, 736 pages.